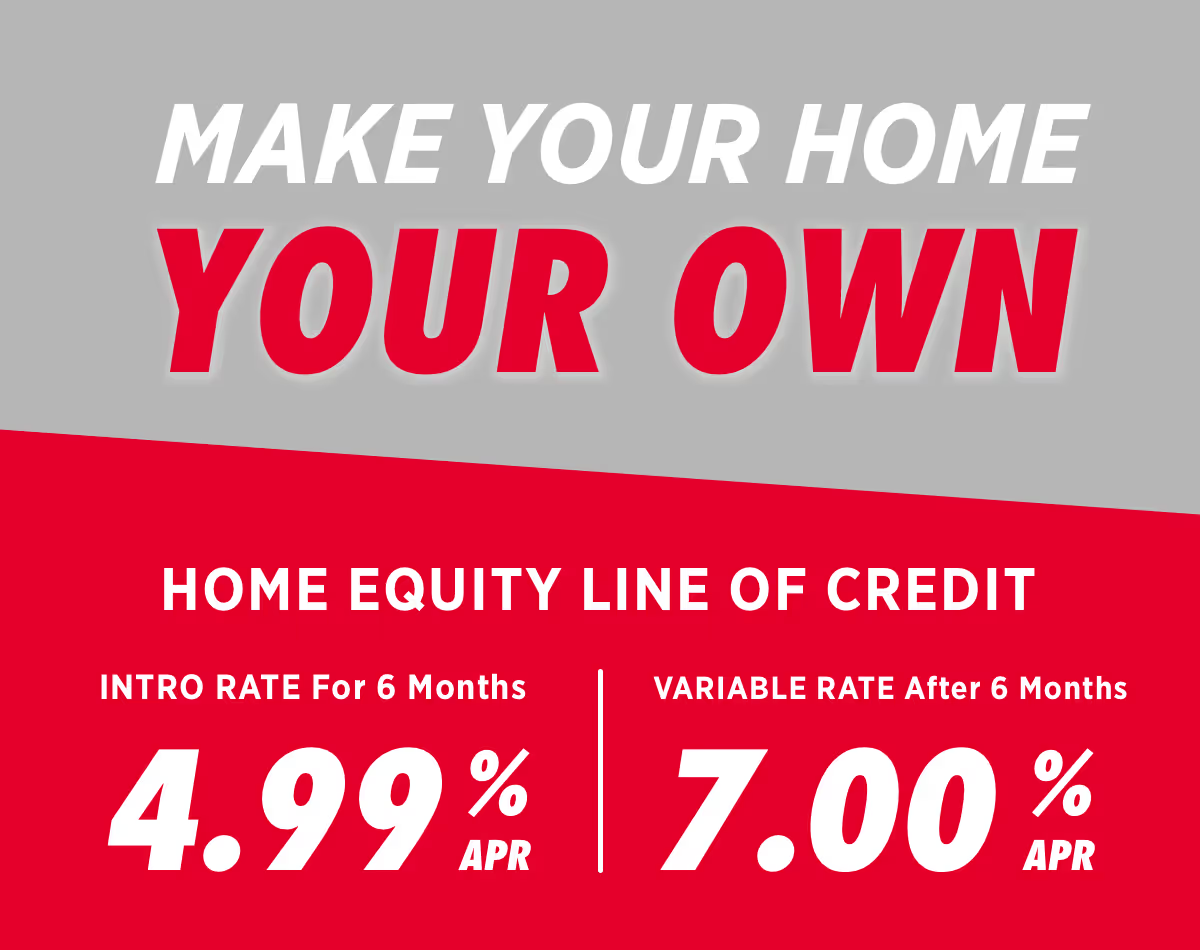

In the ever-evolving landscape of personal finance, the Home Equity Line of Credit (HELOC) remains a versatile and powerful tool. It's essential to consider ways to utilize this financial resource. This article delves into five strategic and beneficial uses of a HELOC, offering insights for homeowners to optimize their financial plans.

Home Equity Line of Credit: A Versatile Financial Tool*

A Home Equity Line of Credit allows homeowners to borrow against the equity in their homes. It's a flexible line of credit that can be used for various purposes, making it a valuable asset in financial planning.

1. Debt Consolidation: Streamlining Finances

One of the most practical uses of a HELOC is for consolidating debt. By paying off higher-interest rate debts like credit cards or personal loans, homeowners can reduce their interest burden and simplify their financial obligations.

Understanding the Advantages

- Lower Interest Rates: HELOCs typically have lower interest rates compared to credit cards and personal loans.

- Simplified Payments: Consolidating multiple debts into a single payment can reduce financial stress and improve budget management.

- Potential Tax Benefits: Interest on a HELOC may be tax-deductible if used for certain purposes, though it's crucial to consult with a tax advisor.

Strategizing Debt Consolidation

- Assessing Debts: Evaluate all debts to determine which ones are suitable for consolidation.

- Calculating Savings: Use a debt consolidation calculator to understand the potential interest savings.

- Financial Discipline: Avoid accumulating new debt after consolidation to maintain financial stability.

2. Home Improvements: Enhancing Property Value

Investing in home improvements is a strategic way to use aHELOC. Enhancements can increase property value and improve living conditions.

Types of Home Improvements

- Structural Upgrades: Improving the home's foundation, roofing, or electrical systems.

- Aesthetic Enhancements: Remodeling kitchens, bathrooms, or adding new flooring.

- Energy Efficiency: Installing solar panels or upgrading to energy-efficient appliances.

Maximizing ROI on Home Improvements

- Prioritize Upgrades: Focus on improvements that offer the highest return on investment.

- Budgeting: Allocate a budget for each project to avoid overspending.

- Hiring Professionals: Engage with reputable contractors for quality workmanship.

3. Vacation Planning: Quality Time with your Family

A HELOC can give you the opportunity to take that vacation you have always dreamed about.

Benefits of Using HELOC for Vacation

- Convenience: Access the funds online, via check, or through a debit card linked to the account

- Flexibility: Borrow only what is needed, when it's needed.

- Preservation of Savings: Enjoy your trip and keep savings for emergencies.

Planning for Vacation Expenses

- Create Your Budget: Determine how much you need for your trip in advance.

- Evaluate Your Finances: Determine if you are able to repay the borrowed funds.

- Use Responsibly: Avoid borrowing more than you need.

4. Emergency Fund: A Safety Net

In uncertain times, having an emergency fund is critical. A HELOC can serve as a backup financial resource.

Understanding the Need for an Emergency Fund

- Unforeseen Expenses: Medical emergencies, job loss, or urgent home repairs.

- Financial Security: Provides peace of mind in times of crisis.

- Accessibility: Funds are available when needed without delay.

Managing the Emergency Fund

- Limit Usage: Use the HELOC only for genuine emergencies.

- Replenishment Plan: Develop a strategy to replenish the fund after use.

- Regular Review: Assess the emergency fund periodically to ensure it meets current needs.

5. Investment Opportunities: Expanding Wealth

A HELOC can be used to seize investment opportunities that might otherwise be inaccessible.

Types of Investments

- Real Estate: Purchasing additional property for rental income or resale.

- Business Ventures: Investing in a start-up or expanding an existing business.

Risk Management in Investments

- Research: Conduct thorough research before investing.

- Diversification: Avoid putting all funds into a single investment.

- Professional Advice: Consult financial advisors for informed decision-making.

*All applications for home equity lines of credit are subject to individual review and approval.